Did you know that a low collection effectiveness index (CEI) significantly impacts your company’s cash flow?

As you’re well aware, maintaining a healthy cash flow is absolutely essential for the success and sustainability of your business. What may not be as obvious is how much cash flow and CEI are connected.

In this blog post, we’ll explore:

- The hidden costs of low CEI.

- CEI industry benchmarks.

- How to keep cash flow “flowing.”

Understanding the collection effectiveness index

What is CEI and why is it important?

CEI is a key performance indicator (KPI) that measures the efficiency and effectiveness of a company’s accounts receivable collection process.

By monitoring CEI, businesses can:

- Assess how well they’re converting outstanding receivables into cash.

- Identify areas for improvement.

Maintaining a healthy CEI:

- Ensures a steady cash flow.

- Helps identify potential cash flow bottlenecks.

- Allows businesses to take proactive measures to optimize collections, reduce borrowing costs and strengthen relationships with customers and suppliers.

The hidden costs of low CEI

What is the impact when CEI falls?

Low CEI costs you opportunities.

Delayed cash flow caused by a low CEI means you have less money available to invest in growth opportunities. Expanding your business, investing in new technology and resources, or hiring additional staff all become more difficult.

Missed opportunities will absolutely hinder your company’s progress and take away from your competitive advantage.

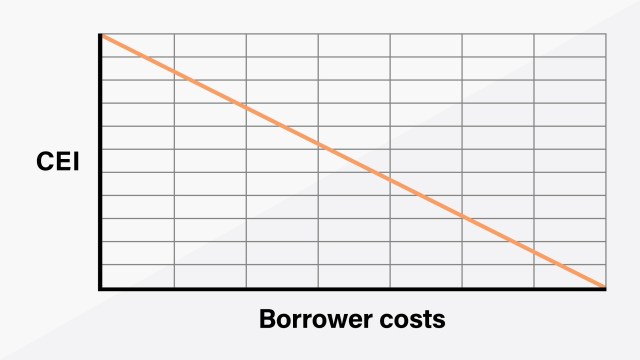

Low CEI increases borrowing costs.

Inadequate cash flow forces businesses to rely on external financing options, such as loans or credit lines. Those sources often come with interest rates and fees, increasing the overall cost of capital.

By improving your CEI, you’ll reduce your reliance on costly borrowing and retain more of your hard-earned profits.

Low CEI strains supplier relationships.

When a business fails to pay its suppliers on time due to poor cash flow, it can strain these crucial relationships. Suppliers may start demanding shorter payment terms or even refuse to extend credit, potentially disrupting your supply chain.

Maintaining a healthy CEI ensures you can honor your commitments and foster positive supplier relationships.

Low CEI reduces customer confidence.

Consistently low CEI indicates inefficiencies in your accounts receivable management. This can erode customer confidence and lead to reputational damage. Customers may view your business as unreliable or financially unstable, which can impact their willingness to continue doing business with you.

A strong CEI, on the other hand, enhances your reputation and builds trust with your customers.

CEI benchmarks

How do you stack up against CEI benchmarks?

While specific benchmarks for CEI vary depending on the industry and business model, it is helpful to have some general reference points. Here are a few commonly cited CEI benchmarks for small businesses and accounting firms in the United States:

Overall CEI benchmark

A commonly referenced benchmark for overall CEI is 80% or higher.

This means that a business is collecting at least 80% of its outstanding receivables within a specific time period, indicating a strong collections process.

Industry-specific benchmarks

Different industries may have different average CEI benchmarks due to variations in payment terms, customer behavior and other factors. It’s important to consider industry-specific benchmarks for a more accurate assessment.

For example, a benchmark of 90% or higher might be more common in industries with shorter payment cycles, such as retail or e-commerce. Industries with longer payment cycles, such as construction or manufacturing, might have benchmarks closer to 70%-80%.

Internal historical benchmark

Another useful benchmark is to compare a business’s current CEI with its own past performance. By tracking CEI over time, a business can assess its progress and set internal goals for improvement.

For example, if a business had a CEI of 75% in the previous quarter, aiming for a 5% increase in the next quarter could be a reasonable goal.

CEI benchmarks are guidelines

It’s important to note that these benchmarks are just guidelines and should only be used as a starting point. Each business is unique, and factors such as industry, customer base and business model can significantly influence the appropriate benchmark for CEI.

It is advisable to analyze your business’s historical performance and industry-specific data to establish a benchmark that aligns with your specific circumstances. Additionally, consulting with industry associations or engaging a financial advisor can provide valuable insights into benchmarking for CEI in your particular sector.

How to improve your CEI

Once you have a clear benchmark in mind, Connect IQ can be your invaluable ally in optimizing cash flow and improving your CEI. By utilizing Connect IQ’s features, businesses can streamline their collections efforts and make better-informed decisions.

And for accounting firms, Connect IQ’s customer-branded client reports make it easy to offer enhanced advisory services to clients to help keep the cash flowing smoothly as well.

For more information on improving your CEI with Connect IQ, click here.