Share expertise, not private credentials

Is your firm still sharing client bank account credentials with staff? There’s a safer and more efficient way to give your staff access to cloud-based applications.

Cautionary tales of compromised credentials

Nothing destroys your clients’ trust faster than a data breach. Protect client information and your accounting firm’s reputation by learning from these common mistakes.

When temporary staffing leads to sudden breaches

- How it happens: Your firm shares clients’ bank credentials with temporary employees, in the hopes of providing a seamless client experience. But when temporary staff contracts end (or end early), your firm has no choice but to notify clients that they must reset their bank access immediately

- The fallout: Forcing clients to suddenly reset access to their bank accounts can cause major interruptions to their businesses. This kind of last-minute request will also raise clients’ concerns about your firm’s overall security and stability.

- The fix: Since temporary staff can come and go often, your firm needs a more permanent solution for granting secure access to cloud-based applications.

When data breach concerns lead to short staffing

- How it happens: Your firm needs to hire remote accounting staff to meet client demand during tax season. But your clients don’t feel comfortable allowing you to share their bank credentials with remote staff. So, you hire local part-time support staff instead, leaving your current team with the bulk of accounting tasks.

- The fallout: Your firm loses some of its best employees to burnout and with them, the ability to support strategic clients effectively.

- The fix: Avoiding remote or offshore staffing forever simply isn’t practical. Your firm needs a more sustainable solution for granting secure, remote access to cloud-based applications.

What are cloud-based applications?

Cloud-based applications, often referred to as SaaS, are delivered to you with no onsite server needed, like QuickBooks® Online for example. You might think of clients’ bank accounts as web-based applications, because you or your staff access them through an internet browser. However, these bank login webpages are actually portals to cloud-based applications. Banks go to great lengths to protect access to client data through the cloud, and so should your accounting firm.

Protect client trust with powerful technology

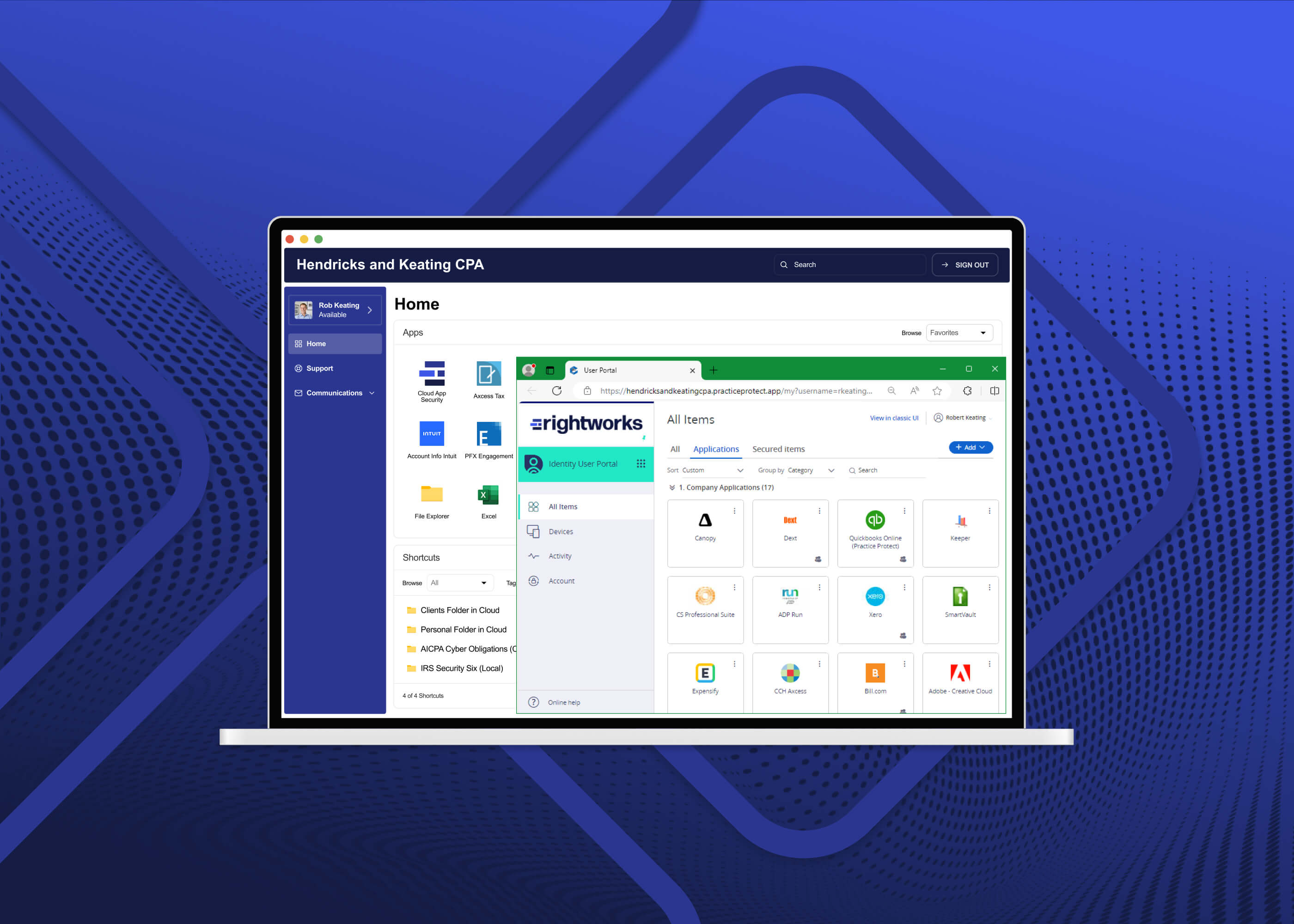

No matter your staffing model, you and your clients should have full confidence in your firm’s security. Rightworks secure cloud solution, OneSpace, is built to keep your clients’ data and your firm’s infrastructure secure from data breaches.

Passwordless cloud app access

Passwords can be used, but never seen. Your team can access apps without knowing the login details, adding an extra layer of security.

Location, time and IP restrictions

Control when, and where, can access data – lock it down to a location or even specific device.

Policy and access control

Create and manage policies for access based on specific users, or group, give and take away access easily.

One-click lockout

Revoke access immediately for offboarding, or lost device – keep everything locked down and safe.

Activity reporting

Keep, secure and manage all logins to both yours and your clients’ tools in one secured location.

On-demand support

Unrivalled support with a team dedicated to responding and assisting with any threat or issue that comes up.

Join 10,000+ firms that trust Rightworks to protect their future