Accounting automation: Two simple words that can evoke fear inside an accounting firm. Instead of letting the fear of automation hold you back, embrace it and use it to help propel your firm forward.

In a recent article I wrote for Accounting Today, talked about the ways automation can elevate your firm—without eliminating the best parts. I even debunked five of the most common automation myths.

So, now let’s talk about what you think you know about accounting automation, why it’s nothing to fear and how it will lead your firm on a streamlined path toward firm improvement.

Defining Accounting Automation

In its most basic form, accounting automation takes manual tasks and does them automatically. Sounds simple, right? By automating tasks such as manual data entry, payroll and expense reports, your firm saves time, data is stored in one place and accuracy improves.

Where does this lead? To enhance visibility, invaluable insights, and streamlined accounting workflow and processes. It also allows employees to spend time analyzing financial reports to create a profitable strategy for your clients—what we like to call advisory services.

Instead of wasting time and talent entering the same information into multiple legacy systems that don’t speak to each other, auditing spreadsheets for errors or preparing the same reconciliations month over month, automation can elevate your accounting team’s valuable education and experience. How? By enabling them to focus on analyzing financial information and using the insights they gather to drive better results for your firm—and your clients.

Understanding AI and Machine Learning

Typically, when we think about artificial intelligence (AI) and machine learning, we’re tempted to run for the hills because we immediately think about robots taking over and leaving us obsolete. Luckily for us, that’s not the case.

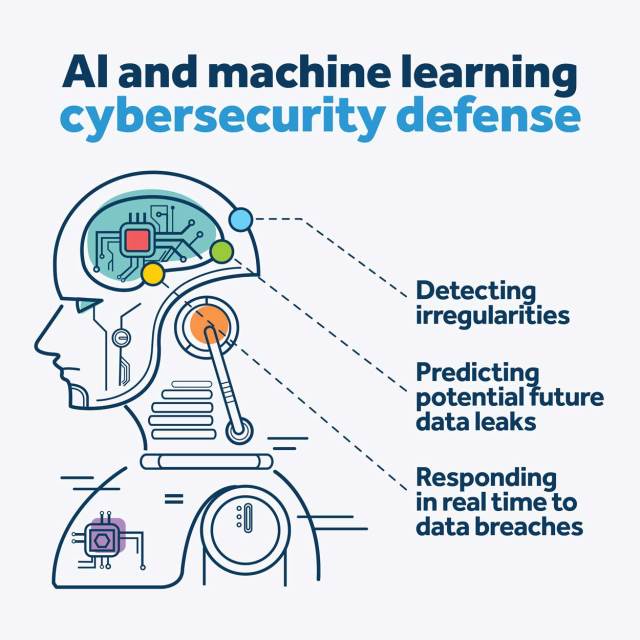

One benefit of AI and machine learning is that they improve cybersecurity for our firms by allowing us to learn about and analyze potential cyberthreats in real time. That’s a huge plus. In fact, here are three ways that AI and machine learning help bolster your firm’s line of defense:

- Detecting irregularities.

- Predicting potential future data leaks.

- Responding in real-time to data breaches.

Another benefit of AI and machine learning is improved financial reporting for forecasting. This will supply insights into how your firm is performing. Think how powerful your firm can be when you have real-time insights. Not only into your own firm but into your clients’ businesses. Sounds like a key opportunity for offering advisory services, doesn’t it?

While AI and machine learning provide wonderful benefits (and I’ve only just scratched the surface here), they’ll always need the human touch. And that’s where your firm and your staff come in.

Simplifying the Accounting Process

Many accounting professionals think that the only accounting process that can be simplified by automation is accounts payable. Contrary to popular belief, with the right cloud-based tech stack, there are several processes that can be automated and integrated together seamlessly within one central location:

- Expense management. Employees can automatically enter expenses and upload receipts, making expense reports a breeze. Need to trigger reimbursement as well? That’s also a possibility with a tool like Expensify.

- Payroll. Process payroll, track time and give employees the options of direct deposits, 401(k) management and more through an online dashboard. No more manual time entry or cutting paper checks with payroll tools like those offered by ADP®.

- Bank reconciliation. Instead of spending time having your team manually reconcile bank statements, use the built-in functionality offered by most accounting software, such as QuickBooks® Desktop or QuickBooks Online.

- Accounts receivable. Take advantage of applications that let you issue and track invoices without manual intervention and stay on top of delinquent invoices with automated reporting. (Spoiler alert: QuickBooks does this, too.)

- Financial reporting. Integrate accounting software with a dedicated reporting application like Rootworks Insights to take a deep dive into financial data to see what is (and isn’t) working well within your firm or your clients’ businesses. You can even set up automated reports to be sent to your clients on a regular basis.

Just remember that you don’t need to jump in and automate everything all at once. Take the time to review all workflows within your firm. Identify the tasks that are most time-consuming and could benefit from automation. Start small and implement automation one task at a time.

Also, keep in mind that there may be hesitancy from team members surrounding automation. Remind them that the tasks you automate will only elevate them—not eliminate them. Ask for their input, listen to their candid responses and include them in the automation process.

Automation in The Modern Firm®

Preconceived notions about automation tend to prevent firms from taking much-needed steps toward becoming modern. You’ll not only save time, streamline processes and elevate your employees, but you’ll start to provide stability for your firm. Because you’re freeing up valuable time for your team to focus less on manual tasks and more on providing advisory services (based on the insights provided by your automated applications!), you’re creating consistent revenue throughout the year.

For more information on capitalizing on automation through the right tech stack, check out our What does automation mean for small accounting firms? eBook.